Market, Limit and Stop Orders – Comparison Guide

It’s crucial to understand the variations between order types since they might have drastically different impacts. Each order type may be thought of as a unique tool with its own set of capabilities. Whether you’re buying or selling, determining your primary goal—whether it’s having your order filled quickly at the current market price or influencing the price of your trade—is crucial. The distinctions between market orders, limit orders, and stop orders, as well as when to utilize each, will be discussed. After that, you may choose which order type is ideal for attaining your objective.

Table of Contents

ToggleIntroduction – What is Market Order and How to Use it?

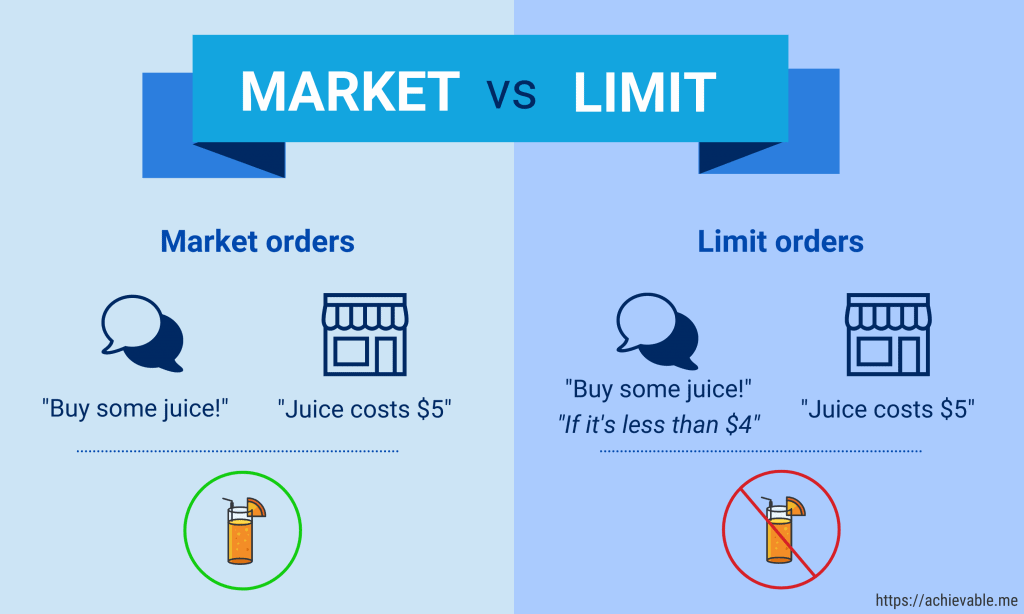

There are a few stipulations: A stock’s quote generally includes the highest bid (for sellers), lowest offer (for buyers), and final trading price. On the other hand, the most recent trade price may not be current, especially in the case of less-liquid stocks, when the most recent transaction might have occurred minutes or hours ago. A market order nearly always ensures execution, although not always at a certain price. A market order is a buy or sale of a stock at the best available price on the market at the time the order is placed. Market orders are the greatest alternative when the primary goal is to complete the transaction as quickly as possible.

A market order is typically the ideal option when you believe a stock is priced right, when you are confident you want a fill on your order, or when you require a quick execution. Market orders should, in general, be placed during market hours.

This might also be true in fast-moving markets, where stock prices can change substantially in a short amount of time. As a result, when placing a market order, the current bid and offer prices are sometimes more relevant than the last transaction price.

Market orders are completed at the following market open after markets shut, which may be much higher or lower than the previous closure. Several variables, including the release of results, business news, or economic figures, as well as unforeseeable events that affect an entire industry, sector, or market as a whole, can influence a stock’s price between market sessions. If you wish to know more things like these then go through other articles on Path To Grow for more.

Limit Order

A limit order may be appropriate if you feel you can buy at a lower price or sell at a higher price than the current quote. A limit order defines a maximum price to be paid or a minimum price to be received on a purchase or sale. Only at or below the maximum price will the order be completed. There is no certainty, however, that the proposal will be implemented.

Stop Order

A stop order is an order to purchase or sell a stock at market price after it has traded at or through a predetermined price (the “stop price”). When the stock hits the stop price, the order is converted to a market order and filled at the next available market price. The order is not executed if the stock fails to reach the stop price.

In the following situations, a Stop order may be appropriate:

- When a stock you own has grown in value and you want to try to safeguard your profit if it starts to collapse.

- When you wish to buy a stock when it breaks out over a specific level and you believe it will continue to increase.

Because it can be used to assist safeguard an unrealized gain or limit a loss, a sell stop order is also known as a “stop-loss” order. A sell stop order is placed with a stop price lower than the current market price; if the stock falls to the stop price (or trades below it), the sell stop order is activated and becomes a market order to be executed at the current market price. This sell stop order may or may not execute close to your stop price.

A stop order can also be used to make a purchase. A purchase stop order is placed at a price that is higher than the current market price, thereby “stopping” the stock from moving away from you.

What are price gaps?

When the price of stock swings drastically up or down with no transaction in between, this is known as a price gap. Earnings announcements, a change in an analyst’s forecast, or a news release might all be factors. Gaps are prevalent at the open of major exchanges when news or events outside of trading hours generate an imbalance in supply and demand.

Stop orders and price gaps

Keep in mind that a limit order will only be filled at the specified limit price or better, but a stop order will be filled at the current market price—which means it might be executed at a price much different than the stop price.

Conclusion

Before you place your trade, familiarize yourself with the many methods you may manage your order; this way, you’ll be much more likely to get the result you want.

Trade executions are influenced by a variety of circumstances. Traders can specify various parameters that impact an order’s time in effect, volume, or price limits in addition to employing other order types.

Also Read:-